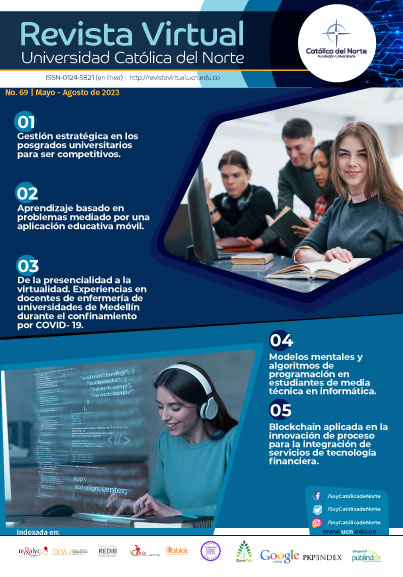

Blockchain applied in process innovation for the integration of financial technology services

DOI:

https://doi.org/10.35575/rvucn.n69a6Keywords:

Automation, blockchain, FinTech, Process innovation, service integrationAbstract

The arrival of different technological developments and the consequent needs of diversification and security in the products of the financial sector has led that financial technology companies (FinTech) being constantly improving their products, in terms of quality, access, security, versatility and efficiency. This research shows the implementation of a process innovation through a methodology of integration of financial technology services, based on blockchain. As a result, it’s possible to enable products with greater security and scalability, revolutionizing the FinTech sector. Through blockchain, digital books are created, and there is greater protection against fraud. Moreover, third parties are removed in transactions and money management is democratized from the integration of transactional solutions, data analytics and automation, leading to a dynamic access to the platform and their services It is concluded that the process innovation, which focuses on the integration of the different services previously mentioned, significantly improves the quality in terms of performance, agility, quality and efficiency for a better user experience, with components of sustainability and social responsibility.

Downloads

References

Acar, O., & Çıtak, Y. E. (2019). FinTech integration process suggestion for banks [Sugerencia de proceso de integración FinTech para bancos]. Procedia Computer Science, 158, 971-978. https://doi.org/10.1016/j.procs.2019.09.138

Albastaki, Y. A. (2020). When technology meets finance: A review approach to FinTech [Cuando la tecnología se encuentra con las finanzas: un enfoque de revisión para FinTech]. In Y. A. Albastaki, A. Razzaque, & A. M. Sarea, Innovative strategies for implementing FinTech in banking (pp. 1-21). IGI Global. https://doi.org/10.4018/978-1-7998-3257-7.ch001

Bayram, O., Talay, I., & Feridun, M. (2022). Can FinTech promote sustainable finance? policy lessons from the case of turkey [¿Pueden las FinTech promover las finanzas sostenibles? Lecciones de política del caso de Turquía]. Sustainability, 14(19), Article 12414. https://doi.org/10.3390/su141912414

Benamraoui, A., & Aljandali, A. (2020). FinTech Innovations: A Review of the Recent Developments and Prospects [Innovaciones de FinTech: una revisión de los desarrollos recientes y las perspectivas]. Bancaria, 12, 85-95. https://westminsterresearch.westminster.ac.uk/item/v3454/FinTech-innovations-a-review-of-the-recent-developments-and-prospects

Broby, D. (2022). The use of predictive analytics in finance [El uso de la analítica predictiva en las finanzas]. Journal of Finance and Data Science, 8, 145-161. https://doi.org/10.1016/j.jfds.2022.05.003

Díaz-Piloneta, M., Ortega-Fernández, F., Morán-Palacios, H., & Rodríguez-Montequín, V. (2021). Monitoring the implementation of exponential organizations through the assessment of their project portfolio: Case study [Seguimiento de la implementación de organizaciones exponenciales a través de la evaluación de su cartera de proyectos: Estudio de caso]. Sustainability, 13(2), 1-20. https://doi.org/10.3390/su13020464

Do, T. (2021). An architecture for blockchain-based cloud banking [Una arquitectura para la banca en la nube basada en blockchain]. In K. Arai (Ed.), Intelligent Computing - Proceedings of the 2021 Computing Conference (pp. 805-824). Springer. https://doi.org/10.1007/978-3-030-80126-7_57

Feuillet-Alzate, J., Correa-García, J. A., & Ceballos-García, D. (2022). Desempeño financiero y operativo del sector energético colombiano en el contexto de los Objetivos de Desarrollo Sostenible. Revista CEA, 8(18), e2022. https://doi.org/10.22430/24223182.2022

Ismail, S. (2014). Exponential Organizations: Why new organization are ten times better, faster and cheaper than yours (and what to do about it) [Organizaciones exponenciales: por qué las nuevas organizaciones son diez veces mejores, más rápidas y más baratas que la suya (y qué hacer al respecto)]. Diversion Books.

Kennedyd, S. I., Yunzhi, G., Ziyuan, F., & Liu, K. (2020). The cashless society has arrived: How mobile phone payment dominance emerged in China [Ha llegado la sociedad sin efectivo: cómo surgió el dominio de los pagos por teléfono móvil en China]. International Journal of Electronic Government Research, 16(4), 94-112. https://doi.org/10.4018/IJEGR.2020100106

Martínez, L. B., Guercio, M. B., Orazi, S., & Vigier, H. P. (2022). Key financial instruments for financial inclusion in latin america. [Instrumentos financieros clave para la inclusión financiera en América Latina]. Revista Finanzas y Política Económica, 14(1), 17-47. https://doi.org/10.14718/REVFINANZPOLITECON.V14.N1.2022.2

Mediomundo, C. (2021). El ecosistema FinTech (Tecnología Financiera) como instrumento de transformación del sistema bancario tradicional en beneficio del cliente. Revista Gestión I+D, 7(1), 12-39. https://dialnet.unirioja.es/servlet/articulo?codigo=8255368

Moore J. F. (1993). Predators and prey: a new ecology of competition [Depredadores y presas: una nueva ecología de la competencia]. Harvard Business Review, 71(3), 75-86. https://hbr.org/1993/05/predators-and-prey-a-new-ecology-of-competition

Nachira, F. (2002). Towards a Network of Digital Business Ecosystems Fostering the Local Development [Hacia una red de ecosistemas empresariales digitales que impulsen el desarrollo local]. European Commission.

Patel, R., Migliavacca, M., & Oriani, M. E. (2022). blockchain in banking and finance: A bibliometric review [blockchain en banca y finanzas: Una revisión bibliométrica]. Research in International Business and Finance, 62. https://doi.org/10.1016/j.ribaf.2022.101718

Restrepo-Ramírez, C. G., Sepúlveda-Rivillas, C. I., & Uribe Castro, J. (2022). Fuentes de financiación para la innovación, según grado de innovación de las empresas de los sectores servicios y comercio en Colombia. Revista CEA, 8(18), e1968. https://doi.org/10.22430/24223182.1968

Thathsarani, U. S., & Jianguo, W. (2022). Do digital finance and the technology acceptance model strengthen financial inclusion and SME performance? [¿Las finanzas digitales y el modelo de aceptación de tecnología fortalecen la inclusión financiera y el desempeño de las pymes?]. Information, 13(8), Article 390. https://doi.org/10.3390/info13080390

Wang, L., Luo, X. R., Lee, F., & Benitez, J. (2022). Value creation in blockchain-driven supply chain finance [Creación de valor en la financiación de la cadena de suministro impulsada por blockchain]. Information and Management, 59(7). https://doi.org/10.1016/j.im.2021.103510

World Economic Forum. (2015). The Future Of Financial Services: How Disruptive Innovations Are Reshaping the Way Financial Services Are Structured, Provisioned and Consumed [El futuro de los servicios financieros: cómo las innovaciones disruptivas están remodelando la forma en que se estructuran, aprovisionan y consumen los servicios financieros]. https://www3.weforum.org/docs/WEF_The_future__of_financial_services.pdf

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Revista Virtual Universidad Católica del Norte

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.